Published articles:

Our team regularly publishes financial articles in an array of publications including the Wood River Weekly and Western Home Journal. We find that writing about economics, the market, and personal finance helps us develop an informed yet approachable way of discussing these topics in person. Money matters can feel stressful enough. We work to diminish the barriers that sometimes inhibit decisions in growing, managing, and preserving your wealth.

Where are the customers yachts?

Where Are the Customers’ Yachts? initially published in 1940, is a book by Fred Schwed, Jr., a former trader on Wall Street and later author, after losing much of his wealth in the stock market crash of 1929.

A view of the market: through the blockchain

An NFT is an intangible asset that exists only in a digital universe. Essentially, these “non-fungible tokens” are digital collectibles kept on a decentralized ledger or blockchain. You can’t touch an NFT, but you can own it. Still don’t understand what all the fuss is about? You may not be alone. An NFT is a unique token that isn’t easily exchangeable with another. The primary use of NFTs is artworks. Millions of dollars of artworks have been selling on the blockchain in the native currency, Ethereum.

Consumer price index primer

The May 2022 Consumer Price Index (CPI) report was higher than expected, with the overall CPI increasing to 8.6% from one year earlier. The CPI measures the average change over time in the prices for a representative basket of consumer goods and services. The CPI increases or decreases based on average price movements inside the market basket.

Equity performance during tightening cycles

The Federal Reserve raises interest rates or tightens the monetary policy to slow down overheated economic growth. Increasing interest rates elevates the cost of borrowing and effectively reduces its attractiveness.

why consider a roth conversion

Introduced under the Taxpayer Relief Act of 1997, the Roth Individual Retirement Account (IRA) is named after U.S. Senator William Roth. Roth IRA contributions are made with after-tax money and are not tax-deductible. The key benefit is earnings within the account accumulate tax-free, and qualified withdrawals after years of growth are also tax-fee. The catch is not everyone is eligible to contribute to a Roth IRA due to annual income limits.

A view of the art market: post pandemic trends

High net worth and ultra-wealthy fine art collectors have been undeterred from investing in art during the ongoing global health crisis. One year ago, the rearview mirror reflected a dismal reality of steep declines in art sales followed by closures and industry downsizing. Yet 2021 has solidly repositioned a market recovery in our line of sight.

The intelligent investor

The Intelligent Investor and Security Analysis, are books published in 1949 and 1934 respectively, authored by the legendary “father of value investing”, Benjamin Graham. Graham was a British-born American economist, professor, and investor. While his life spanned 1894 to 1976, his sound viewpoints on investing still stand today. Warren Buffett, who credits Graham as his mentor, describes The Intelligent Investor as the “the best book about investing ever written.”

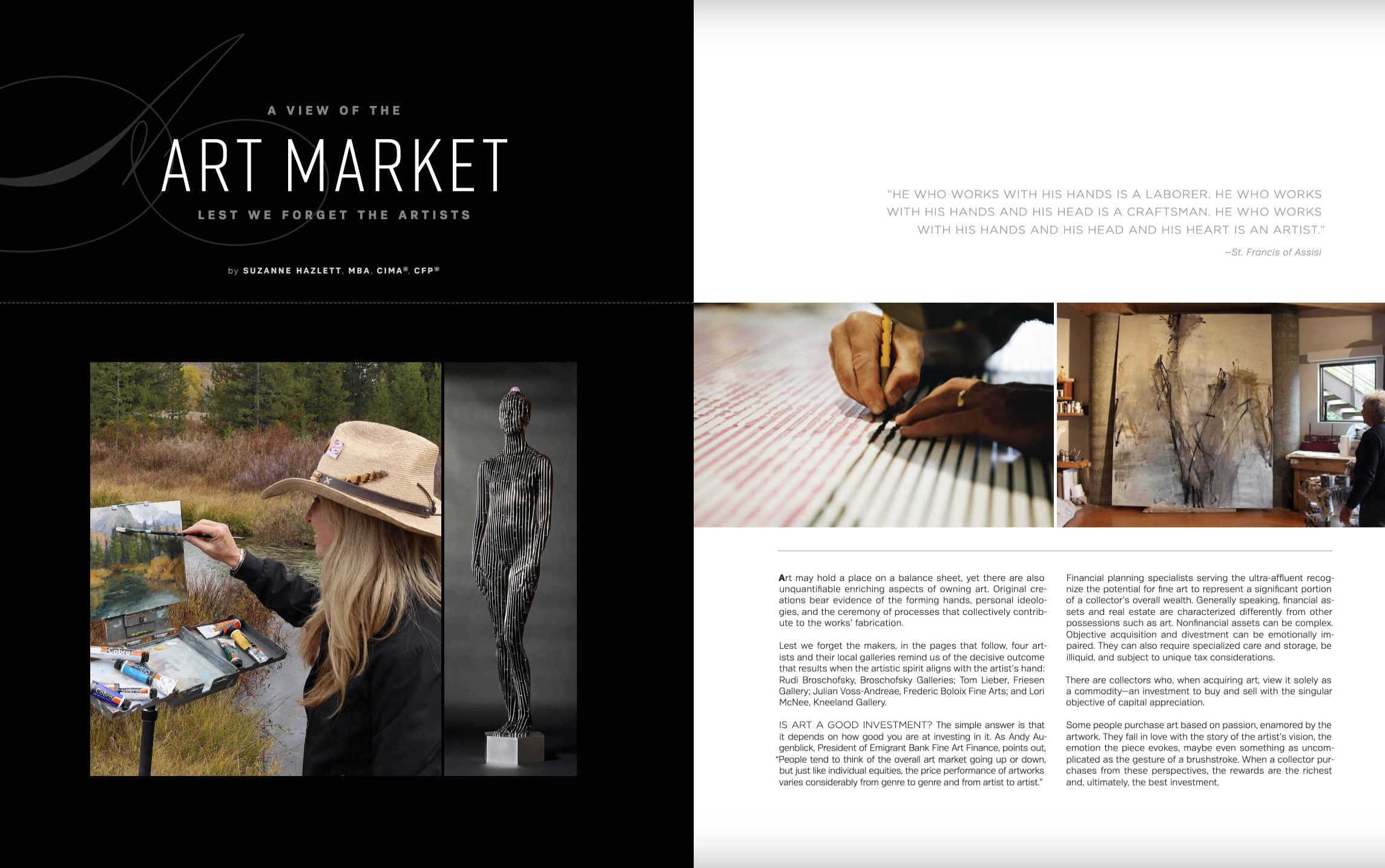

A view of the art market: lest we forget the artists

Art may hold a place on a balance sheet, yet there are also unquantifiable enriching aspects of owning art. Original creations bear evidence of the forming hands, personal ideologies, and the ceremony of processes that collectively contribute to the works’ fabrication.

breaking Ground: women business leaders in sun valley

A feature showcasing seven prominent business woman in the Wood River Valley, including our very own Suzanne Hazlett. Check out her interview below.

Mountain Migration

Relocating is consistently rated as one of the most stressful experiences in life. Nevertheless, the coronavirus has made an impact on motivating people to move. More than 1 in 10 Americans have moved during the pandemic according to a new survey from Zillow, touted as the most-visited real estate website in the country. Among those recent movers, three-quarters say they moved for positive reasons, such as living in an area of which they've always dreamed.

Undoing “I do” after 50

Marriage and divorce are rites of passage that shape many aspects of people’s lives, including their happiness, health, and economic resources.

a view of the art market

When referenced, “the art market” is likely to be narrowly defined by the revenues of the largest auction houses and the worldwide sales of masterpieces. Within a series of articles, we’ll begin with that higher elevation perspective and then craft a view of the state-of-the-art market much closer to home.

Give a little bit

According to the Chronicle of Philanthropy, charitable giving declined six percent during the first quarter this year. In their 1977 hit song Give A Little Bit, British rock band Supertramp sang their famous lyrics, “Now’s the time that we need to share."

Second Opinion

Health. Politics. World events. Investments. It is a crucial time to have an understanding of these diverse aspects of our lives. With so much happening around us, now is the time to be engaged in obtaining financial clarity. A financial wellness check-up, perhaps a second opinion, might be just what you need to prepare better to navigate market uncertainty.

Beyond the fog lies clarity

I was recently asked a question that caused a lump to well up in my throat. “What will happen when I die?” The thoughtful question was posed by someone who wanted to know about the future experience of those she loves and has entrusted with managing the administration of her estate she intends to leave to their stewardship. She wanted to know if there were any steps she could take to make their future responsibilities a little easier, a little more lucid. What she was seeking was a way possible to remove the fog of confusion. She wanted clarity.

financial independence

How would you define financial independence in retirement? Would the ability to make earning income an option define your notion of autonomy, or do you aspire for unlimited funds for unrestrained lifestyle spending? Financial independence will have a different meaning for everyone.

money 101

When vetting advisors, you will encounter an array of professional designations. While financial certifications are not the only thing to consider when evaluating an advisor, they represent expertise in certain aspects of the financial industry. They can also indicate a commitment to professional ethics standards.

Controlling what we can control

Melanie Robbins is a television host, author, and motivational speaker. And while she readily admits she is not a financial advisor, she is sharing with her followers some mindsets that can create a greater sense of control amid uncertainty. Within the outline of her five steps, you will also find specific actions that may help alleviate some of the financial anxiety many are experiencing.

Upside of a down market

Unbridled global fears about the spread of the coronavirus, oil price drops, and the possibility of a 2020 recession triggered the drop. Sound familiar?

Purse strings and Politics

“The personal is political.” It is impossible to know who first uttered the phrase. The meaning is interpreted to convey that political and personal issues affect each other. Indeed, it may be argued our pocketbooks, while personal, are also political.